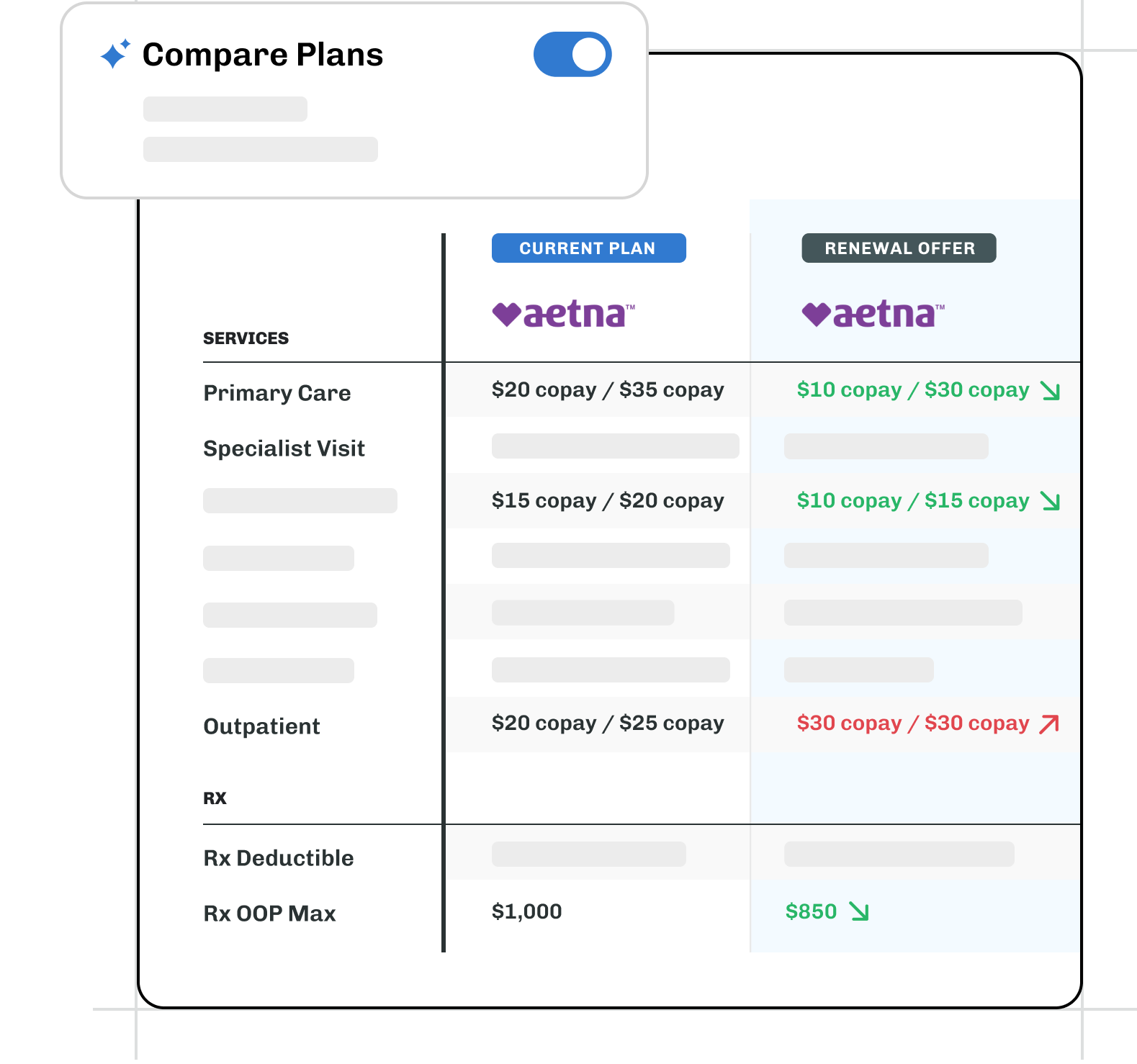

Highlighting the differences between plans helps employers quickly and easily understand the trade offs between competing quotes. This can help expedite their decision making process and thus ensure that both open enrollment and implementation run smoothly. That said, it is a tedious and time consuming process for benefits consultants - until now.

Introducing AI Plan Comparison by PlanYear

PlanYear’s AI-powered comparison engine instantly analyzes benefits plans, surfacing differences that matter to your clients.

"After a decade in benefits, I've witnessed countless hours spent on manual plan audits. Teams either meticulously compare line-by-line—consuming precious time during busy season—or skim quickly, risking costly oversights. This tool transforms that process into a confident, efficient review."

- Michelle Dirckx, Partnerships Lead at PlanYear

How it Works

PlanYear uses a Large-language model or “LLM” to analyze plans and compare them using semantic reasoning. The model isn’t just looking at the numbers, but the actual language in the plan parameters to identify and flag any differences between plans.

The real beauty of the system is the sophistication. Of course the model will flag whether the deductible is higher or lower and identify differences in copays, but it can also give teams the ability to understand more nuanced differences in plan parameters. And, it can do so instantly.

Traditionally, benefit teams have had to highlight differences in plan parameters manually. $1000 deductible in green from the incumbent, $1200 deductible in red from a competing offer. However, quickly, the complexity starts to grow. It’s less obvious at a glance that a $150 emergency room copay is more advantageous than a 20% coinsurance. Even more nuanced: what if the incumbent Plan A provides coverage at out-of-network urgent care centers only "at the nearest facility", while the competing Plan B provides coverage "at the nearest appropriate facility"? This subtle difference would mean Plan B could deny coverage if they determine a closer facility could have provided suitable care. Benefit teams still need to understand this nuance. PlanYear’s solution allows you to see these differences immediately with zero manual analysis.

We’re not just eliminating manual work, however, we’re providing a solution that reduces the risk of human error in a critical and highly visible part of the renewal process. Benefits consultants spend too much time performing tedious yet high consequence tasks at scale. No matter how diligent and detail oriented the individual is, eventually they will make a mistake. With PlanYear, they can both save time and increase the accuracy of their work.

Why does this matter?

For brokers, this means protecting client relationships, avoiding E&O exposure, and delivering more strategic value during renewal conversations. As we all look into new ways to harness AI for our clients, this is yet another step towards delivering meaningful increases in efficiency for our clients while simultaneously improving their experience.

Interested in seeing a demo? Reach out to sales@planyear.com.